The banking sector in Zambia is mostly foreign owned. This has made these very important institutions less willing to tailor and offer solutions suitable to local needs. Most major banks in Zambia remain serving niche or select types of segments of the market.

One local solution to this need for locally tailored financing solutions has seen the Bank of Zambia – BOZ taking a bold step to support a concept and practice of village banking. Village banks today are seen as a future for building locally owned and controlled banks of the future.

Some of the key benefits of village banking is that it enables flexible and tailored lending at lower interest rates. Individuals and businesses which before were being turned away by commercial banks have a source of financing.

A group called Zambia’s Trusted Village Banking (Zatvib) has come together to help each other tackle some of the financial challenges that individuals are facing by saving money as a group which members can borrow and pay back with interest to keep the fund growing.

In order to ensure that members of the group that borrow money do not default or simply refuse to pay back the money, the group ensures that they have proof of residence, proof of source of income, next of kin details and find out from social contacts or close friends if an individual applicant can be trusted before they can access the money.

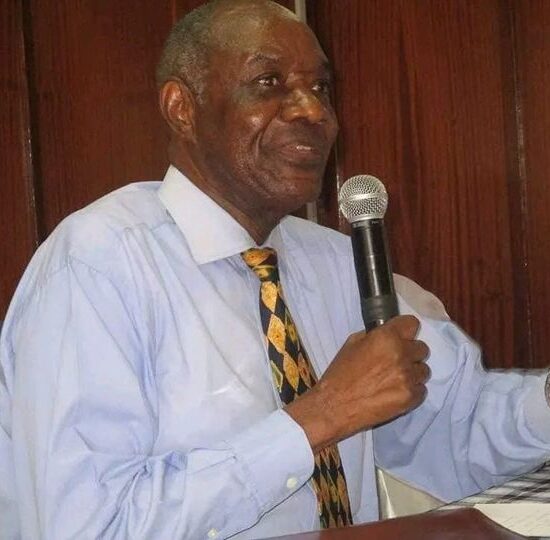

Moses Nonde, a finance consultant and founder of the group says the group, which has an interest rate of 10%, allows members to borrow up to K20,000 in order to help them invest in their various projects or business ventures.

Nonde says members of the group can borrow any amount though large amounts entail that they provide collateral which the group will not hold on to, adding that if one wants to borrow above a certain amount, such an individual will have to provide collateral which the group can hold on to until the money is paid back.

He said this is in order to prevent people from neglecting to pay back the borrowed money or simply failing to pay back. Other benefits for members is that they can borrow twice the amount of money they have saved. So, the more you save, the more you earn via interest and the more you can borrow.

He further said emergency loans which for smaller amounts as agreed by the members can be approved immediately without providing any collateral, but these should be paid back within one month, adding that anything above that should be paid back within a period of 90 days.

Nonde told ZBT that one of the trends observed so far is that most of the members of the group are females or women, as they are known to be more visionary and focused on the future as compared to men, adding that women are naturally good economists as compared to men.

This trend is a challenge to men to start saving more and avoid the notion that men mostly think of the now while women usually look at the future and plan for it, Nonde stated. The village banking funds have potential to grow to huge amounts provided controls are put in place.