The Bank of Zambia (BOZ) has increased the Monetary Policy Rate (MPR) and in effect lending rates by 0.25% ( 25 basis points) from 9.25 percent to 9.50 percent.

Experts have however warned that the increase will create a very strong upshoot to the business structure across the board.

Speaking during the Monetary Policy Committee Announcement and Press Briefing monitored by the Zambian Business Times-ZBT, Bank of Zambia Governor Dr. Denny Kalyalya said the decision to increase the MPR by 25 basis points was informed by the projection that inflation will continue to be above the target band of 6-8 percent over the forecast horizon.

Dr. Kalyalya said Inflation declined further in Q1 2023, albeit marginally. However, it remained elevated and is projected to remain above the 6-8% target band over the forecast horizon. In Q1 2023, inflation averaged 9.6% compared to 9.8% in Q4 2022.

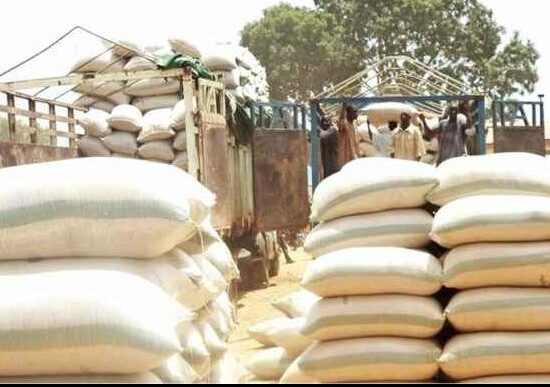

He noted that in April 2023, inflation rose to 10.2% from 9.9% in March. Strong regional demand for maize grain and maize meal as well as the lagged pass-through from the depreciation of the Kwacha against the US dollar were the major drivers.

Dr Kalyala said the inflationary pressures observed in April are expected to persist over the forecast horizon and keep inflation above the target band of 6-8% despite declining slightly relative to the February 2023 forecast.

He explained that inderpinning the current forecast are largely the impact of the recently approved electricity tariffs and elevated maize prices, particularly in 2023, as anticipated in the February 2023 Statement.

He stated that inflation is projected to average 10.5% and 8.4% in 2023 and 2024 compared to 11.1% and 10.1% in February 2023 forecast, respectively. In Q1 2025, inflation is forecast to remain at 8.4%.

He further warned that delays in external debt restructuring negotiations, tighter global financial conditions, higher maize prices, due to the anticipated lower production amid strong regional demand, and the impact of the prolonged Russia-Ukraine war on food and energy prices remain key upside risks to the inflation outlook.

Dr. Kalyalya said the committee also took into account fragile growth, and lingering vulnerabilities and risks in the financial sector.

“Observed budgetary discipline and continued implementation of fiscal consolidation measures, including broader economic reforms, will remain important anchors to achieving lower inflation and macroeconomic stability.” He said.

He added that the decisions on the Policy Rate will continue to be guided by inflation outcomes, forecasts, and identified risks, including those associated with financial stability and external debt restructuring.

Meanwhile experts have attributed the increase the more driven factors of imports as compared to the exports. experts have also warned that the increase will create a very strong upshoot to the business structure across the board

Speaking in an exclusive interview with the Zambian Business Times – ZBT, Economist Kelvin Chisanga said the country need for the country to create a sound will in terms of balance of trade.

“The cost of capital is something that is directed impacted on this and we have already got a situation where the market has not been fairly very well in terms of loan contraction, payment model and even much more the business has been a bit slow so that also complements to be a negative impact regarding the direction that we need to take.” Said Chisanga.

Chisanga said this will obviously create a very strong upshot to the business structure across the board and when you look at the challenging factor on the export market it becomes difficult because obviously when you are financing production and then you want to increase the volume of sales through export it is difficult.