The Bank of Zambia – BOZ, the country’s central banks has for the fifth (5th) time this year failed to raise the required K2 billion per auction as only K889 million was raised during the latest auction results published on July 14, 2022.

The subscription rates are an economic barometer of the economy as an oversubscription is generally seen as a mark of economic confidence by investors while an undersubscription is seen as a score for low investor confidence.

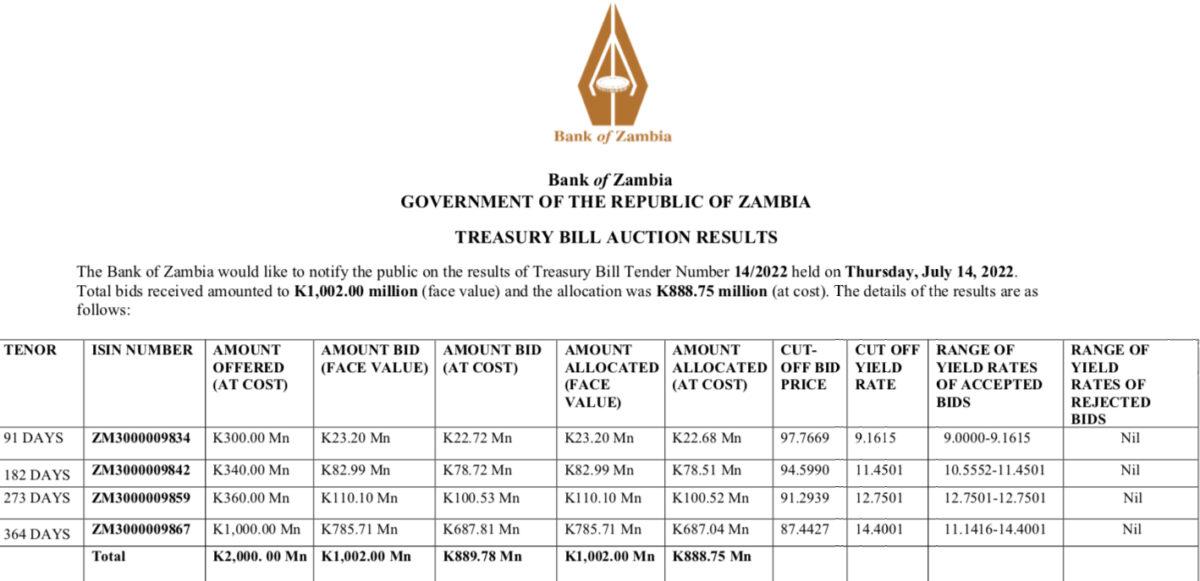

According to the treasuring results seen by the Zambian Business Times – ZBT, BOZ which raises funds on behalf of the central government through issuing treasury bills, only managed to raise K889 million out of the targeted K2 billion, an undersubscription or low uptake of 44%.

A further check of the auction results for 2022 done so far, the central bank has so far recorded a total of five (5) out of fourteen (14) undersubscribed auctions, which translates into a success rate of 64%.

BOZ first recorded an undersubscription on April 21, 2022 when only K580 million was raised out of a target of K2 billion. The second undersubscription was then recorded on May 19, 2022 when K1.5 billion was raised out of a target of K2 billion.

The months of June and July 2022 have been the hardest when a total of three undersubscribed auctions have been recorded. One was on 2 June 2022 when K1.5 billion was raised and then the one on June 16, 2022 when K1.7 billion was raised and the latest one on 14 July, 2022 when only K889 million was raised, all below the target of K2 billion.

BOZ is further struggling with a market dogged by high lending rates which have slowed down investments and dampened consumer spending. Most banks in Zambia use the treasury bills discount or interest rate as a floor price for pricing loans. With the T-bill rates remaining relatively flat despite the single digit inflation rate, lending rates remain high.

Banks are currently charging high lending rates of about 22 to 24% per annum while micro lenders who service the massive number of informal sector employees and local businesses are facing lending rates of about 60% per annum, a situation which is unacceptable in most functional economies.