The Bank of Zambia (BOZ) has maintained the cost of lending at 9% for the third consecutive time this year.

BOZ Governor Dr. Denny Kalyalya said the decision to hold the rates was due to the sharp deceleration in inflation in the second quarter of the year and a further projected decline into the 6-8% target range during the first quarter of 2024.

Dr. Kalyalya said the Monetary Policy Committee was also mindful of the lingering vulnerabilities in the financial sector relatively tight domestic liquidity conditions and weak domestic growth.

Speaking during the Monetary Policy Committee Announcement and Press Briefing monitored by the Zambian Business Times-ZBT, Dr. Kalyalya noted that in the first half of 2024, inflation is expected to average 7.0%.

He explained that over the forecast horizon, inflation is projected to decline to averages of 11.4% and 8.4% in 2022 and 2023 respectively from the outturn of 22.1% in 2021 and these projections are underpinned mainly by sustained implementation of fiscal consolidation and structural reform measures as well as the benefits associated with securing an IMF Extended Credit Facility (ECF).

The Central Bank Governor said sustained implementation of fiscal consolidation and structural reform measures supported by the Extended Credit Facility from the International Monetary Fund are among the key factors expected to contribute to lower inflation.

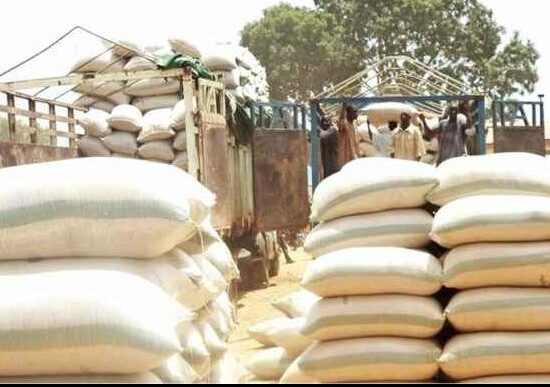

Dr. Kalyalya said the committee however noted that upside risks to the inflation outlook include persistently elevated energy and food prices due to the prolonged Russia-Ukraine conflict and higher than expected domestic maize prices due to the short supply of the staple grain in some neighbouring countries.

He added that other risks include adverse weather conditions, tighter global financial conditions, weakening global growth amid higher global inflation and weak demand as well as supply chain disruptions that could stem from COVID-19 containment measures.

Dr.Kalyalya mentioned that in June, domestic credit growth slowed to 6.8%, year-on-year, compared to 11.5% in March. This was largely attributed to the reduction in lending to government and contraction in private sector credit.

The Governor added that gross international reserves marginally increased to US$3.0 billion (3.7 months of import cover; US9.8 billion of imports) at end-June, 2022 from US$2.9 billion (3.6 months import cover; US$9.4 billion of imports) at end-March.